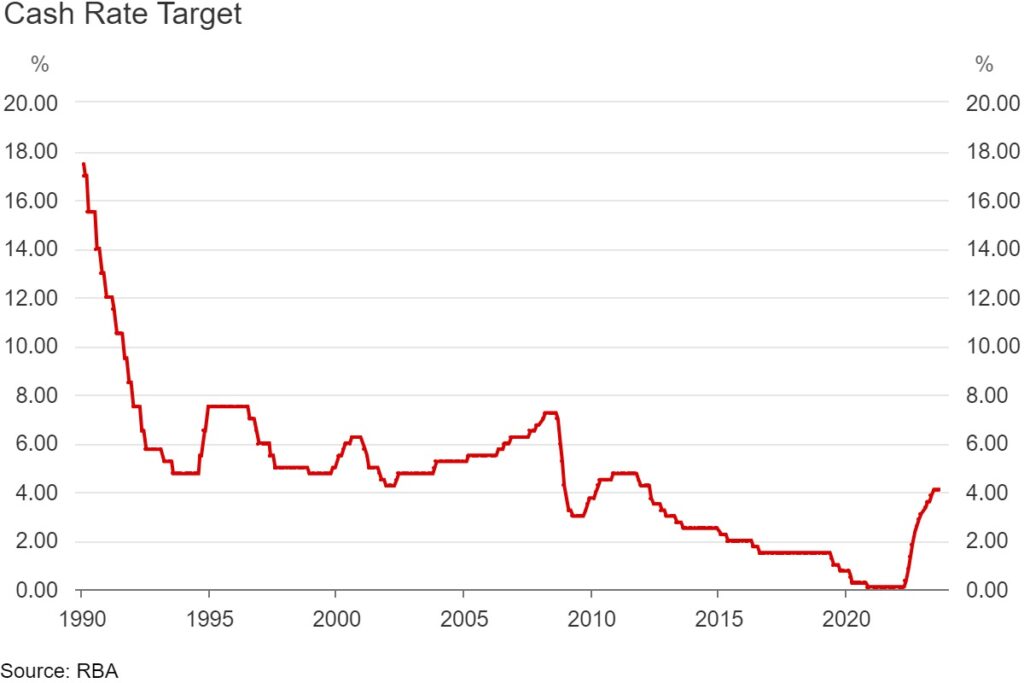

RBA kept Target Cash Rate unchanged at 4.10 %, October 2023

The Reserve Bank of Australia – RBA kept target cash rate unchanged at 4.10 %, October 2023, along with the interest rate paid on Exchange Settlement balances at 4.00 per cent. This decision comes in the wake of a series of interest rate increases over the past year.

Steady Interest Rates Amid Economic Uncertainty

The RBA has opted to maintain steady interest rates, citing their effectiveness in creating a more balanced economy. These rates aim to strike a sustainable equilibrium between supply and demand. Given the economic uncertainties, particularly regarding the ongoing impact of interest rate hikes, the Board has decided to hold rates steady. This pause allows the RBA time to assess the consequences of previous rate increases and monitor the economic outlook.

Inflation: A Persistent Challenge

Inflation in Australia, while past its peak, remains stubbornly high. Goods price inflation has eased somewhat, but the costs of many services and fuel continue to rise. Rent inflation also remains elevated. The central forecast indicates that Consumer Price Index (CPI) inflation will gradually decrease, eventually returning to the 2–3 per cent target range by late 2025.

Economic Growth and Tight Labor Market

The Australian economy displayed stronger-than-expected growth in the first half of the year. However, the nation still grapples with below-trend growth, largely due to elevated inflation impacting real incomes and subdued household consumption and dwelling investment. Nevertheless, labor market conditions remain tight, though slightly eased. Despite this, below-trend economic growth forecasts predict a gradual rise in the unemployment rate to around 4½ per cent in late 2023. Wages growth has increased but remains in line with inflation targets, contingent upon improved productivity growth.

Prioritizing Inflation Control

The RBA’s primary focus remains on returning inflation to target within a reasonable timeframe. High inflation negatively impacts savings, household budgets, business planning, and income equality. If high inflation becomes entrenched in expectations, rectifying it would necessitate even higher interest rates and increased unemployment, both of which are costly. So far, medium-term inflation expectations align with the inflation target, an essential factor to uphold.

Future Outlook and Considerations

Current data trends are in alignment with inflation’s return to the target range and continued growth in output and employment. Inflation is gradually subsiding, the labor market remains robust, and the economy operates at high capacity utilization levels, albeit with slower growth.

However, uncertainties loom, particularly regarding persistent services price inflation and the impact of monetary policy on firms’ pricing decisions and wages. Household consumption’s outlook is also uncertain, with varying financial pressures on households. Globally, the Chinese economy’s outlook remains uncertain due to ongoing property market stress.

Closing Thoughts

The RBA acknowledges the possibility of further monetary policy tightening to ensure inflation returns to target within a reasonable timeframe. This decision will be data-driven and contingent on evolving risk assessments. The Board continues to monitor global economic developments, household spending trends, and inflation and labor market projections closely. The RBA remains unwavering in its commitment to restoring inflation to the desired range, willing to take necessary measures to achieve this goal. In the face of economic uncertainty, the RBA’s steady hand seeks to maintain stability and foster a balanced Australian economy.