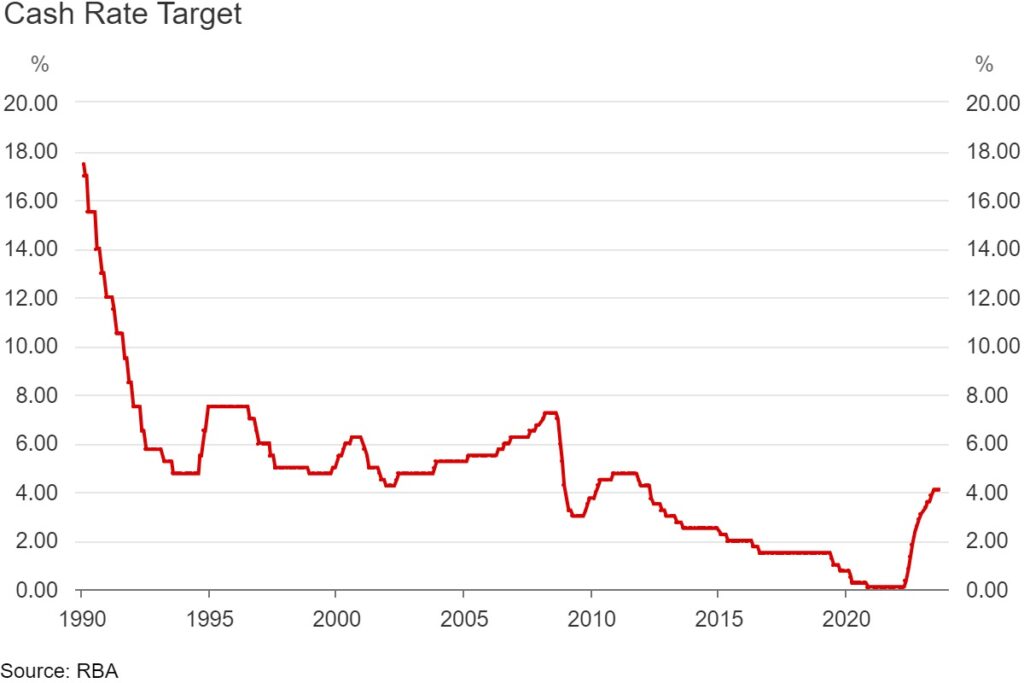

RBA kept Target Cash Rate unchanged at 4.10 %, September 2023

In the final Monetary Policy Decision meeting for Philip Lowe before his RBA Governor tenure ends, RBA kept Target Cash Rate unchanged at 4.10 % for the third month in a row. As per media release, published on the RBA website, Inflation has already crossed its peak and the CPI indicators for the month of July have shown yet another decline. According to RBA data the cost of food items has eased and inflation has eased. Though they highlighted the rent market is still heading north. It is forecasted that CPI inflation will return to the required 2 % to 3 % target range in the year 2025.

What is Target Cash Rate?

It is the rate of interest that the banks pay to other banks in order to borrow money. This rate of interest has direct impact on financial products for consumer’s like home loan interest rate, car finance interest rate, savings deposit interest rate etc.

What is RBA Monetary Policy Meeting?

It is a meeting of RBA board. It occurs every month on the first Tuesday of the month with the exception of January. The board discusses the Australian market conditions, impact of changes in international financial industry and various other aspects of financial industry to determine the level of cash rate that will help RBA achieve the best board objectives. At 2.30 PM on the dat after the meeting the board releases the Target Cash Rate on its website.

Inflation

While the prices of goods have started to stabilize, services, on the other hand, continue their upward trajectory. The rental market is particularly robust, contributing to this persistent inflation. The forecast indicates a steady decline in CPI inflation, with a return to the target range of 2–3 per cent expected by late 2025.

Australian Economy

The Australian economy is currently navigating a phase of below-average growth, and this trend is expected to persist in the foreseeable future. Elevated inflation is placing pressure on real incomes, leading to sluggish growth in household consumption and reduced investments in dwellings. Despite these challenges, the labor market maintains its tight grip, albeit with slight relaxation. The forecast anticipates a gradual rise in the unemployment rate to approximately 4½ per cent by late next year, as the economy and employment growth continue to trail below their potential.

China Impact

In an unprecedented move, Dr. Lowe has singled out China as just one of the myriad “significant uncertainties” poised to exert influence on the forthcoming trajectory of interest rates. These uncertainties stand shoulder to shoulder with the enduring specter of soaring inflation and the unforeseeable ability of households to navigate the swift upsurge in mortgage expenses over the preceding year. Countries all over the world are uncertain about Chinese Economy, since the ongoing stress on the Chinese Real Estate market.

[…] the RBA meeting on 05th Sep 2023, the Australian property market has shown some great results. With most states and capital cities […]