RBA Official Rate Kept at 4.1% in August 2023.

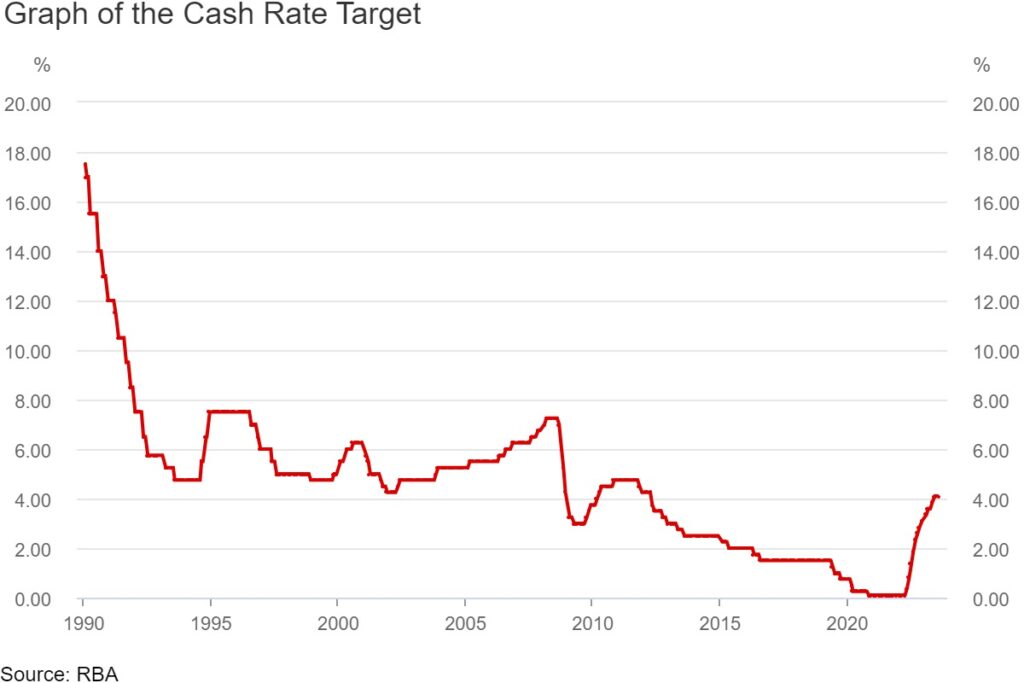

RBA has not changed the official cash rate during its meeting in August 2023. RBA Official Rate kept at 4.10% in August 2023. The cash rate target unchanged at 4.10 per cent and the interest rate paid on Exchange Settlement balances unchanged at 4.00 per cent.

Since May 2023 interest rates have been increased by 4 percentage points. The interest rates hikes appears to be working in making Australia a sustainable nation with balance between supply and demand in the economy. RBA pleadges it will continue to do so. The uncertainty around the economic outlook may have played a big role in the Board’s decision to hold interest rates steady this month. RBA will continue tomonitor the impact of keeping the rates unchanged.

Inflation

Inflation in Australia is still at 6 per cent and it is not showing any signs of heading southwards. Price of food and goods have stabalized, but the prices of fuel, government service fees and many others are still high and mey continue to rise. Victoria being severely under debt and cancelling the Commonweath Games to be hosted in regional areas, is pushing the rates of utilities and government services fees. Impacting home owners and investors. The last weeks auction clearance data showed most of the house auctioned were not owner occupied, they were investment properties. Home rent in both city and suburbia are heading north. The governemnt forecast for CPI inflation is predicted to head down, it will be around 3¼ per cent by the end of 2024. As per the official sources it may reach the target figure 2–3 per cent by late 2025.

Impact on Economy

The Australian economy is going through one of its toughest phases with below-average growth and this trend is is expected to continue for another year or so. Familys budgets and household consumption growth is impacted, as is investments in new properties. Banks are hesitant to offer loans to families as cost of living is still soaring in some states. The government forecasted GDP growth by 1¾ per cent over 2024 and a little above 2 per cent in 2025.

Job Market

Job vacancies and advertisements are still at high levels, some firms report that labour shortages have eased. But multiple companies are going into admistrations and are leaving behind the trail of destruction in the form of job loss and financial losses to suppliers and service providers. Recently another big building company in NSW ewnt bankrupt in last week of July 2023. As both economy and employment forecast are not shoing any good signs, the unemployment rate is expected to rise gradually to 4½ per cent late 2025. It appears there is wage growth for some specific skillsets, but not for all. The wage growth is also impacted by high inflation and rising cost of living. In summary, wages growth is not consistent with the current market inflation. It will only show good results if productivity growth picks up.

[…] month of August 2023. As the Reserve Bank of Australia (RBA) made a pivotal decision to keep the cash rate unchanged at 4.1 percent, its impact was seen throughout the nation in Auction Results 05 AUGUST 2023. With the interest […]